Working Paper Series, Center for Fiscal Studies,

Uppsala University, Department of Economics

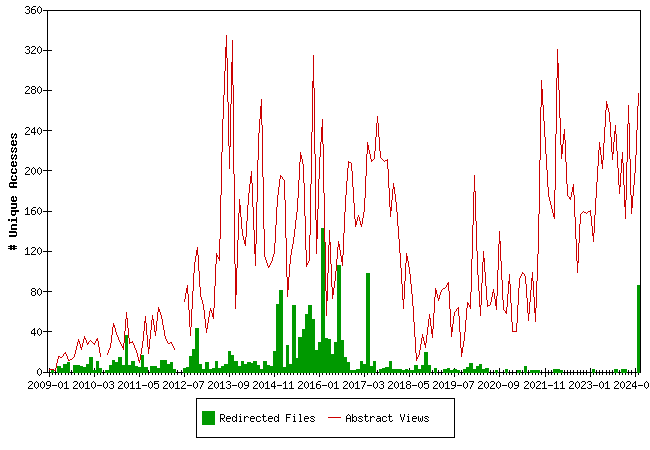

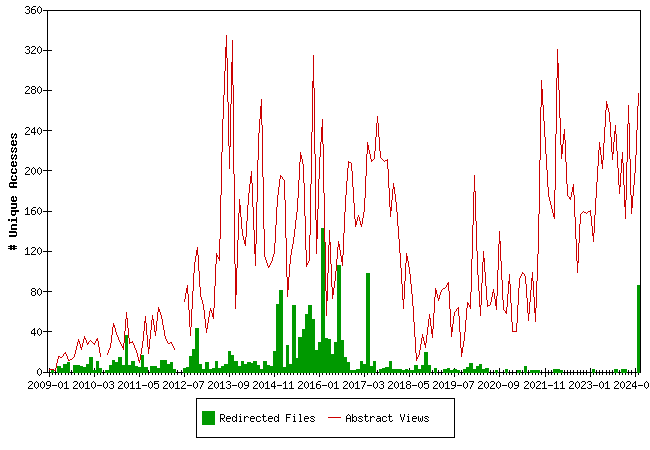

Downloads from S-WoPEc

Fulltext files are files downloaded from the S-WoPEc server, Redirected files are files downloaded from a server maintained by the publisher of a working paper series.

The statistics for 2010-06, 2012-04 (half month), 2012-05 and 2012-06 have unfortunately been lost. We regret this.

The raw data

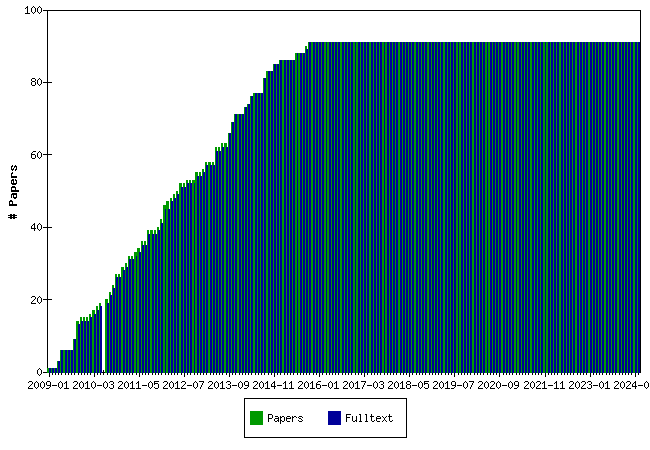

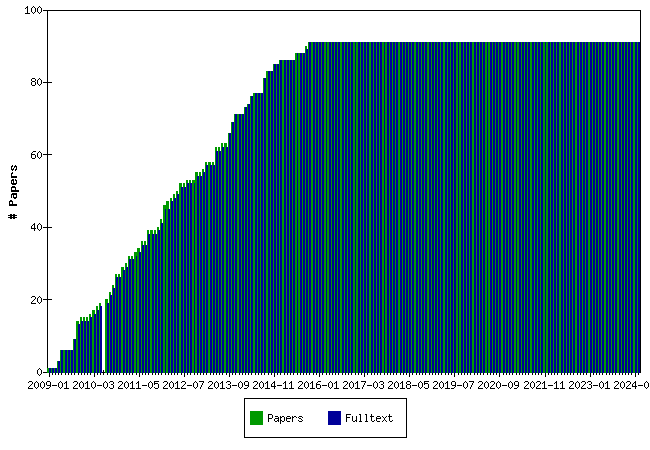

Papers at S-WoPEc

The raw data

Top papers by Abstract Accesses last month (2026-02)

| Paper | Accesses |

Timing of death and the repeal of the Swedish inheritance tax

Marcus Eliason, Henry Ohlsson | 141 |

A History of the Swedish Pension System

Johannes Hagen | 88 |

Swedish Inheritance and Gift Taxation, 1885–2004

Gunnar Du Rietz, Magnus Henrekson, Daniel Waldenström | 25 |

Inheritance and wealth inequality: Evidence from population registers

Mikael Elinder, Oscar Erixson, Daniel Waldenström | 23 |

Bunching and Non-Bunching at Kink Points of the Swedish Tax schedule

Spencer Bastani, Håkan Selin | 22 |

The Effect of Inheritance Receipt on Labor and Capital Income: Evidence from Swedish Panel Data

Mikael Elinder, Oscar Erixson, Henry Ohlsson | 20 |

Do Politicians’ Preferences Matter for Voters’ Voting Decisions?

Matz Dahlberg, Eva Mörk, Pilar Sorribas Navarro | 19 |

The National Wealth of Sweden, 1810–2014

Daniel Waldenström | 19 |

Lifetime versus Annual Tax Progressivity: Sweden, 1968–2009

Niklas Bengtsson, Bertil Holmlund, Daniel Waldenström | 19 |

Taxation and the Earnings of Husbands and Wives: Evidence from Sweden

Alexander M Gelber | 19 |

Who is at the top? Wealth mobility over the life cycle

Stefan Hochguertel, Henry Ohlsson | 19 |

Rank papers for other periods

Top papers by Downloads last month (2026-02)

| Paper | Downloads |

Inherited wealth over the path of development: Sweden, 1810–2010

Henry Ohlsson, Jesper Roine, Daniel Waldenström | 15 |

Lifetime versus Annual Tax Progressivity: Sweden, 1968–2009

Niklas Bengtsson, Bertil Holmlund, Daniel Waldenström | 13 |

Hourly Wage Rate and Taxable Labor Income Responsiveness to Changes in Marginal Tax Rates

Sören Blomquist, Håkan Selin | 11 |

The Internet, News Consumption, and Political Attitudes

Che-Yuan Liang, Mattias Nordin | 9 |

Individual Heterogeneity, Nonlinear Budget Sets, and Taxable Income

Sören Blomquist, Anil Kumar, Che-Yuan Liang, Whitney K. Newey | 9 |

A History of the Swedish Pension System

Johannes Hagen | 6 |

Inheritance and wealth inequality: Evidence from population registers

Mikael Elinder, Oscar Erixson, Daniel Waldenström | 5 |

Is Economics a House Divided? Analysis of Citation Networks

Ali Sina Önder, Marko Terviö | 5 |

Optimal nonlinear redistributive taxation and public good provision in an economy with Veblen effects

Luca Micheletto | 4 |

Marriage Stability, Taxation and Aggregate Labor Supply in the U.S. vs. Europe

Hans A Holter, Indraneel Chakraborty, Serhiy Stepanchuk | 4 |

TAXATION OF CROSS-BORDER LABOR INCOME AND TAX REVENUE SHARING IN THE ÖRESUND REGION

Mattias Dahlberg, Ali Sina Önder | 4 |

Public Goods in a Voluntary Federal Union: Implications of a Participation Constraint

Thomas Aronsson, Luca Micheletto, Tomas Sjögren | 4 |

Distortive Effects of Dividend Taxation

Tobias Lindhe, Jan Södersten | 4 |

Tax Me If You Can! Optimal Nonlinear Income Tax between Competing Governments

Etienne LEHMANN, Laurent Simula, Alain TRANNOY | 4 |

Rank papers for other periods

Top papers by Abstract Accesses last 3 months (2025-12 to 2026-02)

| Paper | Accesses |

A History of the Swedish Pension System

Johannes Hagen | 403 |

Timing of death and the repeal of the Swedish inheritance tax

Marcus Eliason, Henry Ohlsson | 375 |

Swedish Inheritance and Gift Taxation, 1885–2004

Gunnar Du Rietz, Magnus Henrekson, Daniel Waldenström | 134 |

Inheritance and wealth inequality: Evidence from population registers

Mikael Elinder, Oscar Erixson, Daniel Waldenström | 89 |

The legacy of the Swedish gift and inheritance tax, 1884-2004

Henry Ohlsson | 72 |

Bunching and Non-Bunching at Kink Points of the Swedish Tax schedule

Spencer Bastani, Håkan Selin | 65 |

Taxation and the Earnings of Husbands and Wives: Evidence from Sweden

Alexander M Gelber | 62 |

Optimal nonlinear redistributive taxation and public good provision in an economy with Veblen effects

Luca Micheletto | 62 |

The Friedman rule in an overlapping-generations model with nonlinear taxation and income misreporting

Firouz Gahvari, Luca Micheletto | 60 |

Inheritance Taxation in Sweden, 1885–2004: The Role of Ideology, Family Firms and Tax Avoidance

Magnus Henrekson, Daniel Waldenström | 59 |

Rank papers for other periods

Top papers by Downloads last 3 months (2025-12 to 2026-02)

| Paper | Downloads |

A History of the Swedish Pension System

Johannes Hagen | 35 |

Inherited wealth over the path of development: Sweden, 1810–2010

Henry Ohlsson, Jesper Roine, Daniel Waldenström | 32 |

The Internet, News Consumption, and Political Attitudes

Che-Yuan Liang, Mattias Nordin | 19 |

Individual Heterogeneity, Nonlinear Budget Sets, and Taxable Income

Sören Blomquist, Anil Kumar, Che-Yuan Liang, Whitney K. Newey | 18 |

Lifetime versus Annual Tax Progressivity: Sweden, 1968–2009

Niklas Bengtsson, Bertil Holmlund, Daniel Waldenström | 18 |

Timing of death and the repeal of the Swedish inheritance tax

Marcus Eliason, Henry Ohlsson | 16 |

Hourly Wage Rate and Taxable Labor Income Responsiveness to Changes in Marginal Tax Rates

Sören Blomquist, Håkan Selin | 16 |

Monetary policy and redistribution: What can or cannot be neutralized with Mirrleesian taxes

Firouz Gahvari, Luca Micheletto | 15 |

Inheritance Taxation in Sweden, 1885–2004: The Role of Ideology, Family Firms and Tax Avoidance

Magnus Henrekson, Daniel Waldenström | 14 |

Dividend Taxation and the Cost of New Share Issues

Tobias Lindhe, Jan Södersten | 12 |

Rank papers for other periods

Top papers by Abstract Accesses all months (from 2009-01)

| Paper | Accesses |

A History of the Swedish Pension System

Johannes Hagen | 1482 |

Timing of death and the repeal of the Swedish inheritance tax

Marcus Eliason, Henry Ohlsson | 1182 |

Elderly Migration, State Taxes, and What They Reveal

Ali Sina Onder, Herwig Schlunk | 690 |

The National Wealth of Sweden, 1810–2014

Daniel Waldenström | 593 |

Swedish Inheritance and Gift Taxation, 1885–2004

Gunnar Du Rietz, Magnus Henrekson, Daniel Waldenström | 583 |

Bunching and Non-Bunching at Kink Points of the Swedish Tax schedule

Spencer Bastani, Håkan Selin | 582 |

Inheritance and wealth inequality: Evidence from population registers

Mikael Elinder, Oscar Erixson, Daniel Waldenström | 562 |

Income underreporting among the self-employed: a permanent income approach

Per Engström, Johannes Hagen | 550 |

Who is at the top? Wealth mobility over the life cycle

Stefan Hochguertel, Henry Ohlsson | 548 |

Optimal Income Tax under the Threat of Migration by Top-Income Earners

Laurent Simula and Alain Trannoy | 529 |

Rank papers for other periods

Top papers by Downloads all months (from 2009-01)

| Paper | Downloads |

Dividend Taxation and the Cost of New Share Issues

Tobias Lindhe, Jan Södersten | 279 |

A History of the Swedish Pension System

Johannes Hagen | 219 |

Swedish Inheritance and Gift Taxation, 1885–2004

Gunnar Du Rietz, Magnus Henrekson, Daniel Waldenström | 128 |

Inherited wealth over the path of development: Sweden, 1810–2010

Henry Ohlsson, Jesper Roine, Daniel Waldenström | 104 |

The National Wealth of Sweden, 1810–2014

Daniel Waldenström | 98 |

Individual Heterogeneity, Nonlinear Budget Sets, and Taxable Income

Sören Blomquist, Anil Kumar, Che-Yuan Liang, Whitney K. Newey | 86 |

Optimal Wage Redistribution in the Presence of Adverse Selection in the Labor Market

Spencer Bastani, Tomer Blumkin, Luca Micheletto | 83 |

The Signaling Role of Corporate Social Responsibility

Tomer Blumkin, Yoram Margalioth, Adi Sharoni | 81 |

Taxation and the Earnings of Husbands and Wives: Evidence from Sweden

Alexander M Gelber | 77 |

The Internet, News Consumption, and Political Attitudes

Che-Yuan Liang, Mattias Nordin | 67 |

Rank papers for other periods

Questions (including download problems) about the papers in this series should be directed to Katarina Grönvall ()

Report other problems with accessing this service to Sune Karlsson ().

This page generated on 2026-03-01 05:51:20.